salt tax cap repeal

It is important to understand who benefits from the SALT deduction as it currently exists and who would benefit from the deduction if the SALT cap were repealed. The early repeal of the NOL suspension and business credit limits comes amid strong tax revenues and a 457 billion budget surplus.

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

A bill from House Ways and Means Chairman Richard Neal and others would modify and then repeal for two years the 2017 tax laws cap on the federal deduction for state and local taxes SALT and offset the cost over ten years by.

. Over 50 percent of this reduction would accrue to taxpayers in just four. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround. SALT Repeal Just Below 1 Million is Still Costly and Regressive.

In part one of a two-part series Baker Botts William Gorrod Renn Neilson Matthew Larsen Jon Feldhammer and Ali Foyt share how a. The Build Back Better Act passed out of the House of Representatives includes a compromise provision that does not repeal the SALT cap but increases it significantly from 10000 to 80000. Such a plan would be still be very costly and regressive.

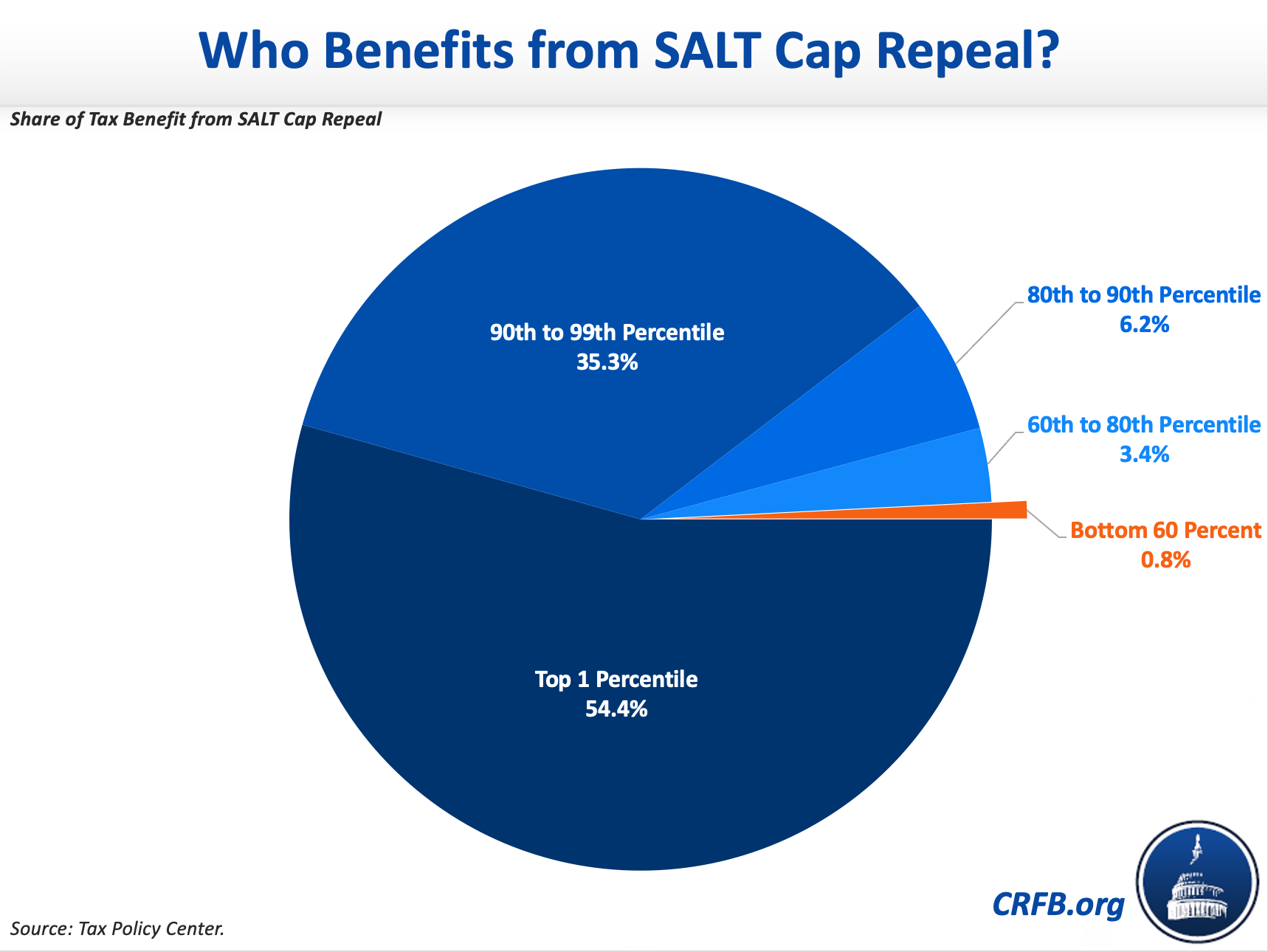

Under a full repeal the top 1 percent of households would receive an average tax cut of at least 35000. According to Golden this would help the small. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent.

If I become majority leader one of the first things I will do is we will eliminate it forever he said at a press conference in Long Island in July of 2020. Expansion of SALT Cap Workaround SB 113 expands the SALT cap workaround by allowing the credit for taxes paid by the entity to offset the California tentative minimum tax of 7 percent of taxable income for tax years beginning on. Enacted by the Tax.

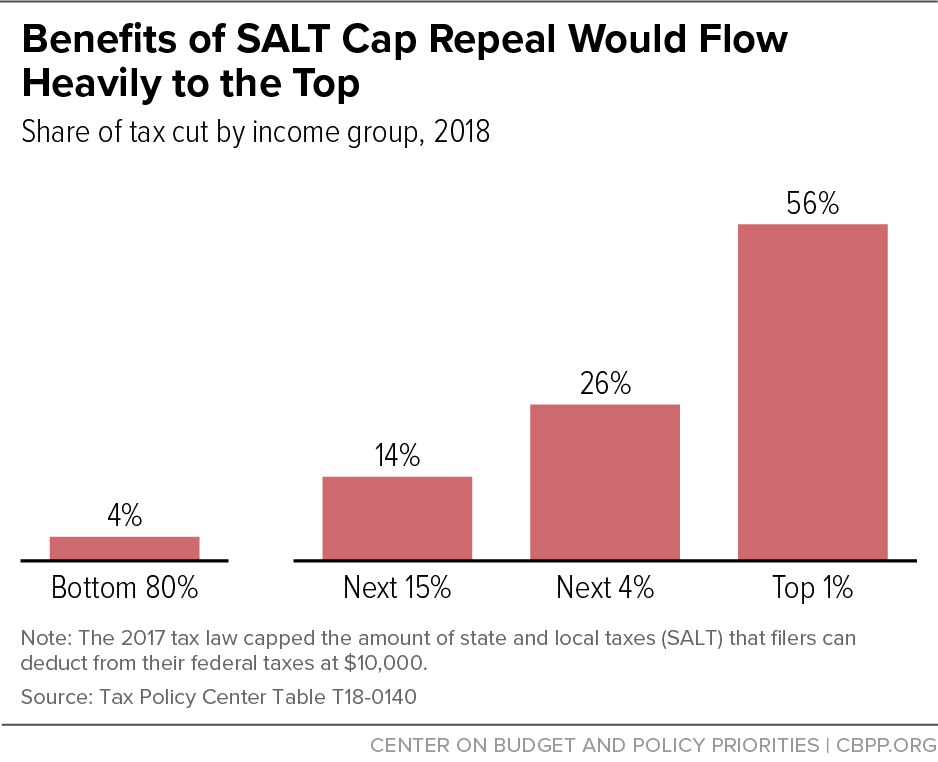

Repealing the SALT deduction cap makes the tax code more regressive. Less than four percent of the benefits of cap repeal would go to the bottom 80 percent of taxpayers. The trend among states to adopt elective pass-through entity taxes or PTETs emerged as a measure to decrease the impact of the SALT cap which was introduced under the 2017 Tax Cuts and Jobs Act.

8 2022 145 AM. Americans with six-figure salaries and high property and state income tax bills will see the most noticeable effects from lifting the 10000 SALT cap according to an analysis by accounting firm. 11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for.

The cap would then be phased back down to 10000 for those earning between 400000 and 500000 per year in Adjusted Gross Income AGI. 54 rows Senate Majority Leader Chuck Schumer D-NY has expressed interest in repealing the SALT cap which was originally imposed as part of the Tax Cuts and Jobs Act TCJA in late 2017. The United States federal state and local tax SALT deduction is an itemized deduction that allows taxpayers to deduct certain taxes paid to state and local governments from their adjusted gross incomeThe Tax Cuts and Jobs Act of 2017 put a 10000 cap on the SALT deduction for the years 20182026.

One would allow unlimited state and local tax deductions for people earning up to 400000 with a limited phase. ITEP previously estimated that three-fourths of the benefits of this provision would go to the richest 5 percent in 2022 and well more than a third of the benefits would go to. Its a blow for Schumer who is up for reelection this year and pledged in 2020 to make repeal of the cap on SALT deductions a top priority if Democrats won control of the Senate.

The SALT deduction reduces the cost of state and local taxes to. SALT cap repeal is an example of a policy simultaneously geared toward families with higher incomes and more wealth. Representative Josh Gottheimer D-NJ one of the repeals staunchest proponents remarked that reinstating previous SALT deductions would be a boon for struggling families Yet the deductions disproportionately benefit the wealthy.

The so-called SALT deduction cap which is poised to sunset in 2026 limits the amount of state and local taxes that Americans can deduct from their federal taxes to 10000. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

Alexandria Ocasio-Cortez D-NY appropriately called the repeal of the SALT deduction cap a gift to billionaires With the growth of remote work its understandable. The income tax portion of the SALT deduction is tied closely to families incomes while the property tax portion is tied to homeownership and home value which are major components of overall wealth. The second proposal suggested by Golden in the Washington Post would fully repeal the 10000 SALT deduction cap but only for those making less than 175000 per year.

The change may be significant for filers who itemize deductions in high-tax states and currently can. Leading advocates for repealing the cap praised the development. Repealing the SALT deduction cap is a top priority for a number of House Democrats in high-tax states such as New York and New Jersey.

But if Democrats do repeal the SALT cap the tax revenue loss could range from 185 billion to 600 billion a pretty big tax cut. Various proposals are under discussion in Congress this week to repeal the SALT cap. To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households making below 900000 or 950000 per year.

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

Dems Don T Repeal The Salt Cap Do This Instead Itep

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

Benefits Of Salt Cap Repeal Would Flow Heavily To The Top Center On Budget And Policy Priorities

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress